To get the full paid experience… Sign up here

Today’s note is 2,600 words (11-minute read)

3.4% of the bitcoin(s) are 34% off

I have been mostly bearish crypto since November 2021 and mostly bullish the USD since January 2022 on the back of higher US rates and accelerating Fed normalization. I think we might be near the peak of the Fed fear trade for a while. I have flipped bearish USD and bullish crypto for now, though I reserve the right to change my mind whenever I want.

My daily note, am/FX, provides much more detail on my USD view but in a nutshell: The US is becoming much less exceptional vs. the rest of the world. Whether you look at interest rates, equity performance, or valuation… The dollar looks like it might be ready to peak here. I mention this because there is a meaningful relationship between the USD, crypto, and all risky assets… It’s generally easier for crypto and risky assets to rally when the USD is weak.

My mantra is “be nimble.” There are going to be times when I flip from bearish crypto to bullish… And then give up on it. And there will be times when I stick with it for months on end. I was bullish into 20k/22k on the chart setup but the blowoff to 17500 took me out. Now, I think the best strategy is to wait until close to month end and average into longs. More specific detail later.

As discussed in MTC22, liquidation is a risk for the next 10 days. Funds with gates and various rules are getting month-end, quarter-end and half-year-end redemption requests right now. I presume these requests will be large. One particularly interesting liquidation play into month end is GBTC. That is the Grayscale Bitcoin Trust. It holds spot bitcoin and currently owns 654,885 BTC or 3.4% of all the bitcoin in circulation.

Pedantic sidenote: The plural of bitcoin can be bitcoin or bitcoins. It should be one or the other. I vote bitcoin.

The problem with GBTC is that it cannot be converted or redeemed into BTC and therefore it can trade at any premium or discount to net asset value. There is no mechanism to convert GBTC into BTC or to make GBTC trade near net asset value (NAV). So, the value of GBTC is correlated to, but also completely unanchored from its NAV.

In theory, one share of GBTC is worth NAV, eventually. But since there is no way of converting GBTC into BTC, the price of GBTC reflects some combination of two things: The price of bitcoin, and the overall demand for an exchange-traded bitcoin proxy.

When crypto is hot, GBTC trades at a premium because people will pay anything to get exposure. When crypto is wintery, like now, GBTC trades at a discount because demand disappears. Here is the GBTC discount / premium to NAV over time:

GBTC premium or discount to NAV

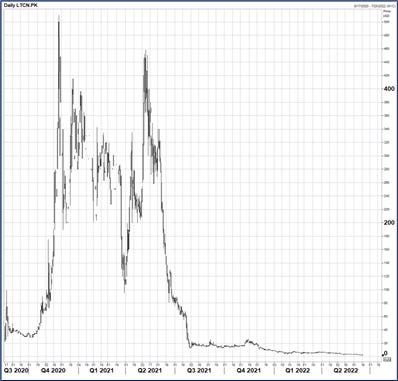

Before we get to why the GBTC story is heating up right now, you want to see something really stupid? This is the premium on the Grayscale Litecoin Trust. It’s a product similar to GBTC, but for Litecoin. Complete lunacy.

LTCN premium / discount to NAV

Anyone that bought LTCN in 2020 or the first half of 2021 was making an epic and obvious mistake. That’s not hindsight, LTCN NAV is well-known and published daily. Buying a trust at 60X NAV is stupid. Here is the market price of LTCN since launch:

LTCN price, 2020 to now

People bought this thing at $400 when it was worth $25. And now it’s worth $4.15 and it trades at $2.53. Lulz.

As I say in Alpha Trader: Markets are extremely, but not perfectly efficient.

Anyhoo, there are two interesting plot points in the ongoing GBTC saga. First, guess who the biggest holder of GBTC in the world is… Three Arrows Capital. AKA: 3AC. That’s the multibillion-dollar looks-to-be-insolvent crypto fund that is likely to be entering (or in) liquidation right now. Here is a snip from Bloomberg, showing the top holders of GBTC:

Top holders of GBTC

That is a huge position! Average daily volume in GBTC is 6.1 million shares so a rapid sale of Three Arrows GBTC holdings would surely leave a Sasquatch-sized footprint.

Not all liquidations are done in a panic. Sometimes another fund will show a bid and the liquidating entity (3AC) will pass the entire stake off to that fund and nobody ever has to touch the market. There is no guarantee that a huge chunk of GBTC must hit the market.

But if I was going to bet on the timing, if there is a sale, it would be between now and the end of the month. Therefore, there could be an opportunity to buy GBTC at an even wider discount into month end. My guess is that once the liquidation ends, the discount will compress as people buy the lottery ticket into plot point number two: the July 6 ruling on whether GBTC can convert to a spot bitcoin ETF.

If Grayscale wins approval, the discount would almost instantly close to zero. The probability of an SEC approval is extremely low, but not zero. You can read Grayscale’s side of the story here. If there is no approval, I doubt the discount will widen much given there is so little expectation priced in.

Given I am bullish bitcoin here, and there is a good chance of liquidation flows into month end, and there is a low-probability lottery ticket event on July 6…

This has been a free preview of the latest MTC. The rest of the note talks about a specific GBTC tactical idea, a longer-term idea, and a ton of other stuff like the hilarious timing of the bitcoin ETF launches.

To read the rest of this note (and a new note every week!) please subscribe here.

I will send some partial notes and some full notes to the free list.

Thanks.

bd