Today’s note is 2500 words (10-minute read)

Bitcoin is a hedge for loose policy, not inflation

As the narrative has evolved from Satoshi’s “peer-to-peer electronic cash system” to the more recent bull narrative of “Wall Street and institutional adoption,” skeptics argue bitcoin changes its story more than Amber Heard. They heap particular scorn on the “inflation hedge’ and “store of value” narratives because bitcoin has collapsed 75% from peak during the current inflationary and real-income destroying hellfire brought on by MMT-style policies post-COVID.

I jumped on the bandwagon a bit in last week’s MTC, as I wrote the following:

Bitcoin is not an inflation hedge, it’s not a store of value, it’s not a useful form of money for commerce, and it’s not (yet) a simple monetary solution for wealth inequality or any other societal ill. But it does seem to work as an MMT hedge. And we are eventually in for more, not less MMT in the future.

QE and MMT are the new orthodox playbook for central banks. When they started QE and MMT, bitcoin went up. When they stopped, it went down. When they start QEMMT up again (which they will) bitcoin will probably go up again.

A few people asked: “You sure it’s not an inflation hedge?” and when I stopped to think about it, I was not so sure. Bitcoin is still up 150% since April 2020 and if I think about where it is vs. how much other assets have moved, overall BTC performance since US MMT began in March/April 2020 is not too shabby. So let me dig into this.

Many discussions and arguments about how an asset has performed come down to starting points. Gold bulls will point to gold’s 20-year performance while bears will point to its 10-year performance, and both sides can hold up solid empirical evidence. If you pick the ding dong lows, it looks good and if you pick the ding dong highs, it looks bad. Surprise surprise!

Is bitcoin a good inflation hedge?

Today, I want to try to answer the “bitcoin as inflation hedge” question by comparing the performance of bitcoin to other inflation-protection assets through this cycle. There are a variety of assumptions and decisions one has to make when conducting an exercise like this, so I will try to lay out all my assumptions and see where we land.

1. Choosing a starting point

There is no easy answer to the starting point question, which is: “When did the current inflationary hellfire begin?” Here are some possible start dates we could choose:

March 31, 2020

The Fed announced a massive easing package, and Congress passed the CARES act (massive US fiscal) in mid-to-late March 2020. These sowed the seeds of the current inflation and as such you could argue that March 31, 2020, is a pretty good start date to choose. This is using 20/20 hindsight though! At that time, the entire economy was shut down and most Americans were worried about deflationary collapse, not inflation. Nobody was thinking “what assets can I buy to protect myself from inflation?” Not a single person.

Massive quantitative easing has been deployed many times in the past, with no inflationary impact, so one would have to have known that the global fiscal response was larger than the global economy could handle and would lead to supply chain and inflation pressures. Past fiscal efforts around the world had not created much inflation over the past 20 years, so again… traders and investors were not thinking about inflation in March 2020. That said, with the benefit of hindsight, that’s the true start date.

People will claim that it was obvious inflation was coming, but it was anything but obvious for many months after the Fed eased and the CARES act was announced. Here is the vibe in April 2020:

The stores were empty, everyone was locked down, and prices were falling.

April 30, 2021

This is the month US CPI went above 2% and it’s also the point where there was an uptick in searches for “inflation” on Google as you can see in the next chart. At this point, housing was making headlines, vaccines were flowing into American arms and the economy was reopening. If you were an active investor, this is the most realistic time you would have started looking around for inflation hedges.

Google search activity for inflation (United States, January 2020 to now)

November 30, 2021

Many economists, including a majority of the 400+ PhDs at the Federal Reserve, expected inflation to be transitory. In November 2021, the Fed, and just about every other economist that been holding onto the transitory narrative, capitulated. This is the point at which many decided to put on inflation hedges. Obviously, in hindsight, this was the worst possible time to do so, but in reality, many were most worried about inflation in November 2021.

These two October 2021 covers from The Economist capture the narrative zeitgeist of Q4 2021.

Crypto optimists would obviously love to use the ding dong low in March 2020 as the starting point for all measurements of crypto performance but it’s worth remembering that barely anyone was getting involved at that time, and if they were, it had nothing to do with inflation. Crypto inflows didn’t accelerate until late 2020 and didn’t moon until 2021.

https://www.gemini.com/state-of-crypto

So, you have three starting points. One that only works if you have perfect hindsight, and two that are realistic.

2. Choosing the competitors

The standard macro inflation hedges are short bonds and long gold. There is plenty of room for debate there, but those are definitely the one-two go to hedges in most people’s minds. A more complete list of possible inflation hedges includes:

Equities

Gold and silver

Crypto

Commodities

Bonds

Real estate

.

3. The results

We can evaluate the performance of securities in a brute force way by comparing returns. We can also compare Sharpe ratios. The Sharpe ratio adjusts returns by volatility because a 10% return with 3% volatility is much more attractive to most investors than a 10% return with 30% volatility.

Sharpe is not necessarily always the best measure in an experiment like this, though, because if you want an inflation hedge, you might just want the most volatile thing that produces the biggest absolute return in times of inflation. That is, if you are a degen ape, you want max money, not max Sharpe.

On the other hand, if you do care about volatility, the problem with Sharpe is that it assumes a normal distribution of returns. The further you go out the crypto curve, the less normally returns are distributed. Returns and Sharpe do the job for this type of analysis, even though neither one is perfect. Neither one is correct or incorrect, they are just two different ways of looking at the problem.

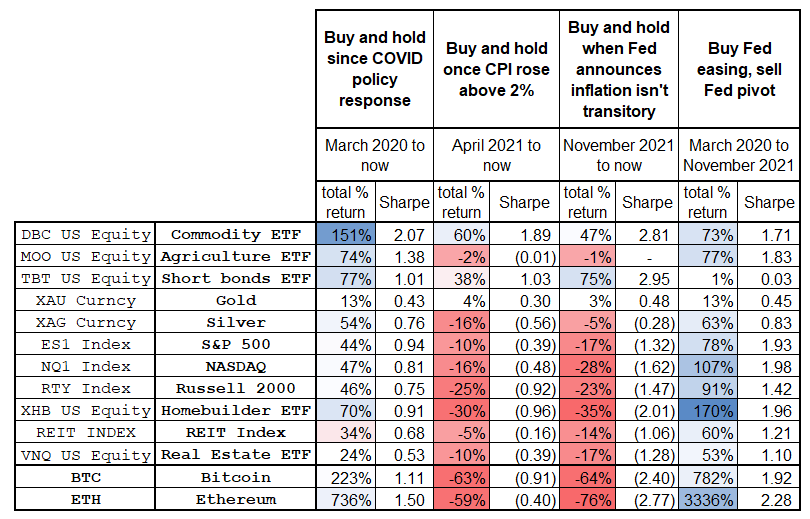

Here are the results for the inflation hedge trades I chose, using the start dates I listed above:

Return and Sharpe ratio, variety of inflation hedges, four periods

Here are my takeaways:

BTC and ETH have deep negative returns since inflation turned higher. On the other hand, they are among the best performing assets since the COVID policy response in March 2020 if you do not adjust for volatility. If you have perfect hindsight, crypto was the best inflation hedge. Then again, GME and AMC have better returns than crypto in that period... That doesn’t mean they are good inflation hedges!

The most interesting feature of BTC and ETH is how they ripped immediately higher in Q2 2020 because balance sheet and money supply expansion removed downside deflation risks and eliminated the left tail of complete economic collapse. Later, starting in Q2 2021, crypto continued to move higher as inflation expectations rose and monetary policy remained loose. But as soon as monetary and fiscal policy turned, crypto collapsed. The cause effect seems pretty clear.

Long commodities and short bonds were much more consistent inflation hedges that did not rely on a perfect entry point or 20/20 hindsight. Even if you were slow to buy commodities, or slow to go short bonds, you did fine. The Sharpe of commodities has been excellent as they have mostly gone up in a straight line until very recently.

The earlier you bought any of these assets, the better you did. And if you squared up everything in November 2021 as the Fed pivoted, you won huge. This exit timing was not impossible and did not require 20/20 hindsight as it was super clear the Fed was changing its priorities when inflation became a political story in Q4 2021. Many commentators, including me, had the bearish risky asset view at this time. Still, even if you didn’t sell at peak inflation panic, you did OK in commodities and bonds. You got smoked in stocks and crypto.

Gold. Yuck. It has traded like a low-beta, random walk defensive equity since COVID. And it’s negative carry.

There has been one inflationary episode since bitcoin was born, and bitcoin went up before the inflation started, then collapsed as central banks reacted to it. That is the key takeaway here:

Bitcoin is a risky asset and a hedge for loose policy. It’s not a hedge for inflation. It reacts to policy, not inflation.

Since hitting the mainstream, bitcoin has gone through two Fed cycles. It bottomed when the Fed turned dovish in early 2019, and it bottomed again when the Fed did QE in March 2020. Then, bitcoin topped when the Fed pivoted to a hawkish stance in November 2021. The more Wall Street onboards bitcoin as its shiny new macro toy, the more it is clear: bitcoin is a high-volatility risky asset that works as a hedge against fiscal and monetary insanity. It’s the best one of them all! It’s better than gold, better than stocks, and better than other commodities when it comes to hedging MMT (in both directions). But since it reacts to policy, not inflation, it’s not a good inflation hedge the way commodities and bonds are.

One final thought on this topic: The best simple measure of whether or not monetary policy is loose is to look at the direction and level of US real interest rates as measured by inflation-protected bonds. Here is the US 10-year real rate vs. bitcoin back to 2017:

Bitcoin vs. US 10-year real yield (inverted)

You can see that this is not a tick-for-tick relationship, but you can also see that when real yields are falling (purple line going up), it’s easier for bitcoin to rise. When real yields are rising (purple line going down) it’s easier for bitcoin to fall.

This makes sense if you view bitcoin as a fiat debasement / MMT hedge. The purchasing power of fiat declines when real rates are negative, and it rises when real rates are positive. As such, insurance against debasement should be most in demand when real rates are below zero. That is exactly how bitcoin trades.

The lessons from this cycle are:

Bitcoin is a good hedge for loose monetary policy, and this is turbo true when fiscal is also crazy loose.

You need to be quick. You can’t wait for inflation to rise, because by the time inflation rises, policy pivots and pushes back on inflation (and crypto) via higher real rates and tighter policy. Next time the Fed turns dovish, don’t hesitate: Buy bitcoin.

Bitcoin isn’t about inflation; it’s about how monetary and fiscal policy create and stamp out inflation. It’s about getting ahead of those waves, not about hedging inflation. If you want to hedge inflation, use commodities or bonds.

All this analysis is fun but remember that bitcoin is younger than either of my two sons. This is the first cycle that features institutional adoption, and we should not be 100% sure that the next cycle will look the same as this one. Even the long-standing and well-known relationship between Fed policy and stocks is somewhat unstable. A univariate model is never going to work perfectly out of sample.

Alrighty then. I hope that helps. Next time someone says bitcoin isn’t an inflation hedge, you can reply guy as follows: “Well, no, neither is gold tbh. I go long commodities and short bonds to hedge inflation. I use bitcoin as a hedge for insane monetary and fiscal policies, but I am quick to get out when policies reverse.”

Final Thought

You’re either with us or against us:

That’s it! Thanks for reading.

Don’t follow the crowd. Don’t fight the crowd. Think for yourself.

bd

how does a fish that lives its life in the sea ponder the cycles of water?

would it be fair to say that btc has only ever existed in a regime of excess liquidity and to attempt a meta description of it from metrics obtained within this regime is a bit like the pondering fish?