The crypto bull trade continues but MSTR has come too far

MacroTactical Crypto #29

This is a free preview of MTC 29… In this note:

Why the halving cycle is now another endogenous bull factor for crypto.

Calculating “fair value” for MSTR.

Why MSTR is a flat or short situation now.

Trading strategy for the week ahead.

:

For the full MTC experience, please subscribe here

Today’s note is 2000 words (9-minute read)

The crypto bull trade continues but MSTR has come too far

The Merge dominates the crypto zeitgeist as buying continues into a touted week of 19SEP merge date. The Goerli Testnet Merge went live yesterday and everything is looking A-OK. No sign of any explosions or huge arc flashes of light and heat blowing up the blockchain, so there should be another four weeks of buying the rumor before it’s time to sell the fact in ETH.

Meanwhile, regulators are blowing as much hot air and sound and fury at crypto as they possibly can, and the market’s response so far has been like:

The tornado could take a long time to get here, or it might never arrive, so for now there is not much concern despite the brief histrionics after the Coinbase insider trading complaint described nine tokens as securities.

Speaking of Tornado... regulators tossed another arbitrary Molotov cocktail at crypto this week. Two good stories about it here:

https://thedefiant.io/usdc-addresses-banned

https://techcrunch.com/2022/08/12/suspected-tornado-cash-developer-arrested-in-amsterdam/

There has been a huge bounce in equities and that got a jetpack surge after the weak US CPI figure on August 10.

The cryptocentric story remains bullish (as long as you ignore the US regulators, which basically everyone is doing) … and the boot is off the neck of macro for a bit. Here is how BTC, ETH, and NASDAQ have done so far this year:

Monthly return of BTC, ETH, and NASDAQ (2022

July was a mega month for everything risky, but you can clearly see Merge Fever in there as ETH exploded higher. Also worth noting: February 2022 is the only month this year where crypto and NASDAQ went opposite directions (NASDAQ down, crypto up).

You can see ETH Fever in this next chart too. BoomerCoin volatility is bumping along the lows while ETH vol is mid-range.

BTC vs. ETH rolling 10-day standard deviation of daily returns

The overall vibe at Club Crypto is still pretty lame, but ETH is dancing like nobody’s watching in the side room.

Halving pain is over

Here is a flashback to MTC#5 for context before I discuss where we are now in the bitcoin halving cycle.

From MacroTactical Crypto #5: Nobody will tell you when to sell

November 2021

Halving cycle is bearish

Every 1200 days or so, the reward for mining bitcoin transactions is cut in half. Each halving has been followed by an epic bull run, then a super cold period, then another bull run in anticipation of the next halving cycle. See:

Bitcoin performance over the three halving cycles

The BTC and crypto hype machine is 10X more powerful than the 1999/2000 internet hype machine. Nobody is ever going to tell you when to sell. It is borderline verboten for anyone in crypto to even utter a bearish word. Keep that in the back of your mind. Every story you ever hear is going to be bullish. It’s cool to HODL but just make sure you can survive the next winter.

Also note in that chart that each bull run is less impressive than the last as market cap rises and it becomes impossible for the next wave to outgrow the last. This is why the Plan B model becomes less and less accurate. The halvings are mathematically less important (lower overall impact) and the law of large numbers kicks in. It’s easier to grow from 1 billion to 1 trillion than it is to grow from 1 trillion to 1 quadrillion. Obviously.

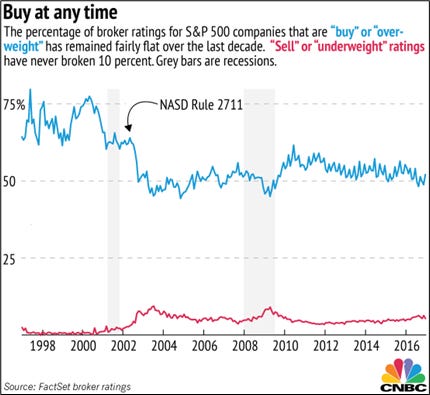

Sidenote: As part of its continuing speed run through the history of TradFi, Big Crypto has copied the 1999 Wall Street playbook as it employs primarily three recommendation levels: BUY, STRONG BUY and IRRESPONSIBLY LONG! Crypto is down 50%-80% off the highs and still 99% of all the recommendations on every Big Crypto or YouTube or whatever are BUY BUY BUY. All the way down.

After the dotcom crash, FINRA tried to balance the buy vs. sell noise with Rule 2711. Here is how well it worked:

Exchanges, custodians, advertisers, VCs, investors, entrepreneurs, developers, and everyone else in crypto space wants you on board! Most crypto analysis is advertising masquerading as research. Keep this in mind in the next bull run. Nobody will ever tell you when to sell. That’s why you have to think for yourself and know the bias of the content you consume. End of sidenote.

The reason I cut and pasted that MTC5 excerpt is that the Halving Cycle has now turned. Here is the chart from that note, up to date. It is a thing of beauty…

:

This has been a free preview of the latest MTC. The rest of the note covers why the halving cycle is another endogenous bull factor, calculating fair value for MSTR, why MSTR is a flat or short situation now, and trading strategy for the next week.

To read the rest of this note (and a new note every week) please subscribe here.

Thanks.

bd