Click on the play button above to read this with your ears.

The full MacroTactical Crypto archive is linked at the end of this post. I sent MTC #1-10 by email but added SubStack with this edition (#11). I have been bearish crypto since November as we are in the bad part of the macro and the bitcoin halving cycles. Full thesis in the archives (MTC 4, 5, 6, 7, 8 especially).

“Why can't we not be sober?

Just want to start this over

And why can't we drink forever?

I just want to start this over.”

Tool, “Sober” (1993)

Apes Together Strong, Diamond Hands, NGMI, WAGMI, frens and countless other in-group slang has quickly gone from sounding kind of cool and in the know to more like cringe or “cool beans!” or “word up” or whatever. The AMC Spaces are providing deeper insight into the actual, true madness of crowds that has been with us since January 2021. I mean, everyone knew it was madness, but it was kind of cool for a while as WSB ran the markets (democratization!) and deepeffingvalue shared screenshots that gave you that same frisson you get when you see a lotto ticket winner with one of those awesome giant checks.

I too, would like an awesome giant check!

- Everyone, 2021

Now, it is the morning after one hell of a party, everyone wakes up like Casper in the final scene of the movie Kids, feeling a bit more, but not completely sober. Empty beer bottles and full ashtrays everywhere.

Searches for “apes together strong,” which first peaked on the release of the latest Planet of the Apes movie in 2017 and then made a new high in March 2021, have followed the path of GME and AMC common equity. Those two stonks were the first in a rolling series of megapeaks in every single crazytown zero-cashflow meme and narrative driven asset from the ARKK peak in February, Doge in April, and all the way to Solana in November.

June FOMC pivot… But the party rages on. November, inflation becomes political, and Powell drops transitory… A few nerds leave the party, but it mostly rages on. Then boom: January, QT enters unannounced like the cops. Knock knock knock. Boom… The front door comes down and everyone runs out of the kitchen and down the tiny corridor to the only other exit, in the back. Broken ankles. Smashed bottles. Buzzkill.

To be clear, I am not saying Solana is in any way comparable to Doge; I’m just saying all the super hypey meganarrative assets followed similar, time-staggered mountainlike trajectories up and down along their own very special narrative arc. Doge got the Elon pump(s) while Solana’s moonshot got a turbo thrust from Packy McCormick’s now legendary Solana Summer piece. The coin (SOL) has now come just short of completing a full round trip.

Each story was different, but in the end many of the stories were kind of… The same? Fun fact that people might not remember is that the entire Summer of Solana piece was sponsored by Solana. It was clearly marked as such.

I am a fan and regular reader of McCormick, and he’s extremely honest and transparent about his promotional / paid materials. I just highlight this as a remarkable and transparently direct cause and effect between a company promoting its own stock or security or token or whatever, and an epic, 400% rally in that security-like asset that is somehow not actually a security. There will be some great financial history books written about this era.

Like other high-risk assets, the entire crypto universe from Doge to Solana has now come under macro pressure as the Fed dumps the failed transitory strategy and heads toward normalization. The tide of liquidity lifts all boats and drops boats onto rocks just the same.

Markets did the Wile E. Coyote for a while, resisting gravity’s inevitable pull as many tried to pooh-pooh the normalization story. “The Fed is still buying assets!” Markets are more forward-looking than that. They see tightening like Cole Sear sees dead people. There was barely a mention of quantitative tightening in late December, then QT ripped like a fire through the narrative woods in early January, lighting the most flammable speculative assets ablaze.

OK, now what?

I have been a cyclical bear on crypto since November as discussed in almost every MTC so far (see full archive at the end of this doc if you wanna read back) and I stll feel we need one more huge leg lower before the dead wood is clear. Below are four signposts that would indicate to me we have unwound the excesses of 2021.

Fed turns dovish on weaker US economic outlook. Wait dude, wut? It’s hilarious that I’m talking about hints of the next Fed easing cycle when Powell & Co. have not even finished the last easing cycle and are about to embark on tightening. But this is why the fiat debasement narrative makes sense to me and why I’m a cyclical bear but structural bull on crypto. We are in a debt trap. The Fed is trapped and has been for years.

The Fed could well be hiking right into the teeth of economic weakness. They could be slamming the monetary brakes just as the fiscal brakes have already been stomped and everything rolls over. For example, one important source of fiscal fuel, The Child Tax Credit, saw its last payment to US households go out December 15, 2021. With inflation raging, fiscal stimulus is verboten, Build Back Better is DOA, and we may have already driven over the fiscal cliff.

Recent US economic data releases have been either fine… or completely horrendous… and nothing in between. It’s hard to say if the US consumer is tapped out, or omicron just has everyone hiding for a few more months. I have been writing about the turn in the US data in my daily macro note and you can get a sense of what’s happening in “am/FX: Something Weird is Going On” (free). I am a global macro guy; these crypto pieces are mostly just for fun. If you want to read my macro daily, you can subscribe here. It’s $49/month. Cheaper yearly.

Anyway, the TLDR on the US economy is that cracks are appearing, but they could be superficial or severe. Nobody knows yet because of omicron.

The second sign that the crypto unwind is nearly complete would be the completion of a full round trip in Solana. In “MTC 7: These charts all look like mountains” I discussed the never ending revolving door of altcoins in and out of the top 15 as that world is 96% narrative / hype / shill … and 4% substance.

As gamblers chase lotto-like returns and influencers pump their bags, most altcoins skyrocket and quickly return to earth, leaving hundreds of altcoin charts that look like silhouettes of K2. I am not expert on who will win the race for L1, L2 and tokenomic supremacy, but I don’t think it’s crazy to think that SOL might be a coin that breaks the default zero-hero-zero pattern and retains some hope of recovery. It has strong and vocal backing from well-financed and well-respected peeps like SBF and is one of the few coins outside BTC and ETH that could attract sticky institutional money.

A full round trip in Solana could be a bullish signal for crypto as it would fully wipe out one of the sexiest and most compelling crypto bull runs of 2021.

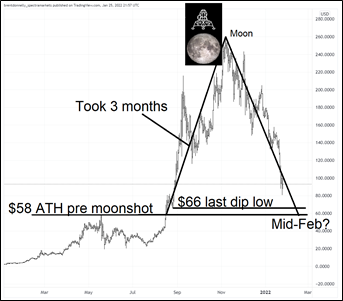

There is a thing in financial markets called time symmetry which is a super basic way of looking at how securities move. You can read a paper about it here if you like, but you don’t have to. The takeaway is: If something can go from $66 to $259 in three months, we should consider it reasonable to think that it might also go from $259 to $66 in three months.

Solana almost did a round trip to the moon

I know this sounds simplistic, but I’ve been trading for a long time, and I can tell you that if you have no other information about an asset or how it might move, symmetry is a good way to estimate future volatility and the possible path of least resistance. At right is a chart of Solana with some key points marked.

The first target as the SOL shuttle makes its return voyage from the moon back to earth would be the important and tight support zone between $58 and $66. These are a) the old all-time high of $58 that was breached in a major signal of strength in mid-August 2021 and b) $66, the last dip level before SOL left earth’s atmosphere. If there is time symmetry, we should be back at 58/66 around mid-February. Of course, markets and life are not that elegant, but this gives you a starting point for where to buy the dip in SOL. Given the high correlation between all the coins and tokens, if SOL holds, that’s a good sign for crypto. Observant readers will observe that a true round trip would put Solana at $20, the triple bottom from May/June and that would be the next target if we crack $58.

I like buying SOL $58/$66. This is not investment advice. Do your own due diligence. Trade your own view.

If you think this symmetry stuff is stupid, that’s OK. I get it. Please don’t @ me to tell me how stupid it is. Technical analysis is not for everyone. On to the next signpost…

A false break of the Saylor line. Bitcoin haters have a special dislike for Michael Saylor because he is betting his company on what some would argue is a multibillion dollar coin flip. Win or lose, you can argue it’s one of the smartest moral hazard trades of all time. I see the genius in it. If bitcoin goes to zero, has he really lost anything? His company was worthless and he was nearly in jail in 1999. He has discussed this before on various podcasts. He knows what it’s like to get zeroed and he doesn’t really care. In case you don’t know the story, here’s a little visual context:

Microstrategy stock 1998 to now

If bitcoin goes to a million, he’s a god. It’s similar to the logic of Cathie Wood’s approach. You go all-in on a theme or asset, and never give up until you either ride off into the sunset like a hero or your bets go to zero and you retire on the management fees. It takes a particular form of courage to make bets this large. Saylor is a super smart guy who knows exactly what he is doing and is being completely transparent about it. If it works, it works. If it doesn’t, hey. Life goes on.

Anyway, MicroStrategy’s average on their 125,000 bitcoins is around $30,000. There are people who believe there will be some sort of negative convexity as BTC breaks down through $30,000 and MSTR goes underwater on its treasury BTC holdings. I’m not so sure about that given the debt MSTR issued to buy the bitcoin is unsecured and doesn’t roll til 2025 or something—but I’m not an expert on this. Some people think there could be a worst-case scenario where the underlying business is troubled and debt servicing requires outright bitcoin sales. If you have any good writeups on this (pro or con) please send them to me. Whether or not this is true, enough people believe it. Therefore, the price action around $30k is worth watching. This is doubly important given all the bounces off $28,800/$29,300 (see chart on next page).

A particularly bullish BTC setup would be a break down below $28,000 and subsequent close above $30,000. A false break of a key level like this is known as a Slingshot Reversal and it’s a super bullish setup because it flushes all the stops, clears the longs, sucks in more shorts, and then… Whipsaw moonshot.

Bitcoin anywhere near $20,000. On the way up, the smash through $20,000 was one of the cleanest, most epic technical breaks I can remember, in any market, ever. Jared Dillian nailed that break and everyone remembers it. Bulls not already trapped long at higher levels will be salivating down there. Here is the chart:

Bitcoin since 2018

I continue to believe we are in the bad part of the bitcoin halving cycle and the bad part of the Fed cycle. So I am in no rush to get long. That said, I’m most bullish bitcoin because I think it has proven its use case as a risky asset / gold competitor and has no real competition on that use case. Meanwhile, every other coin and token (including ETH) has competition. In a world where infinite coins can be created until someone finds the optimal solution to the trilemma (decentralization, security, scalability)… Bitcoin will be a safer (though admittedly less lotto-ticket like) investment while every other coin is more of a speculative dart throw. Also, if you believe that institutional adoption is an important part of the crypto thesis, institutional demand and holding of bitcoin will be sticky and persistent while their demand and quick flip / exit from altcoins and even ETH will be determined by the outlook for each coin relative to the other.

To summarize: I am a buyer of crypto as follows:

If the US economy turns and there is the faintest sign of a Fed pivot back to neutral/easing, buy everything. I will surely write about this before, or as it’s happening.

++SOL at $58/$66

++Bitcoin if it breaks below $28,000 and then closes above $30,000.

++Bitcoin at $22,000 (ahead of the $20,000 level).

I will also probably be tempted to get short ETH if it bounces towards $4,000 again, but let’s see.

Finally, update on the two coins I have been hating on the most.

AXS (first hated in MTC#4, 08DEC) has gone from $106 to $50 and SAND (first hated in MTC#8, 06JAN) has gone from $5.25 to $3.00. With the insider selling of SAND likely done for now, there is no reason to hate it anymore. Long-term I think AXS probably goes to zero but whatever I’m moving on to new thoughts. The GameFi bubble has burst for now and it’s getting boring to keep writing negatively about it.

Thanks for reading. Feedback and criticism are always welcome.

/// bd

The big driver of crypto these days is global macro.

If you want to know global macro, sign up for my daily,

Global macro is my real job. MTC is just for fun.

The full MTC archive:

MTC 1: Two cascading failures at the ATH

MTC 2: Bitcoin crashes, seasonals and other cool stuff

MTC 3: Embrace the Nonsense

MTC 4: The Stadium Curse + 7 other warning signs

Short ETH at 4210, stop 4902, target 3010

MTC 5: Nobody will ever tell you when to sell

MTC 6: The three big hype cycles of 2021

MTC 7: These charts all look like mountains

MTC 8: Buy some mittens

MTC 9: Flat is strong

Target reached on short ETH (3010) Short SAND, long BTC idea

MTC 10: Literally: not a game

MTC 11: Sober

Buy SOL 58/66, Buy BTC 22k, Buy BTC if <28k and then close >30k

Subscribe to AM/FX here

Markets and Trading Commentary Disclaimer

This material has been provided by Spectra Markets, LLC (“Spectra Markets”). This material is confidential and therefore intended for your sole use. You may not reproduce, distribute, or transmit this material or any portion thereof to anyone without prior written permission from Spectra Markets.

This material is solely for informational and discussion purposes only. Spectra Markets is not a registered investment advisor or commodity trading advisor. This material should not be viewed as a current or past recommendation or an offer to sell or the solicitation to enter into a particular position or adopt a particular investment strategy. Spectra Markets does not provide, and has not provided, any investment advice or personal recommendation to you in relation to any transaction described in this material. Accordingly, Spectra Markets is under no obligation to, and shall not, determine the suitability for you of any transaction described in this material.

To be clear: Your individual circumstances have not been assessed. You must determine, on your own behalf or through independent professional advice, the merits, terms, conditions, risks, and consequences of any transactions described in this material. Securities described in this material may not be eligible for sale in all jurisdictions or to certain categories of investors. This material may also contain information regarding derivatives and other complex financial products. Do not invest in such products unless you fully understand and are willing to assume the risks associated with such products. Neither Spectra Markets nor any of its directors, officers, employees, representatives, or agents, accept any liability whatsoever for any direct, indirect, or consequential losses (in contract, tort or otherwise) arising from the use of this material or reliance on information contained herein, to the fullest extent allowed by law.

The opinions expressed in this material represent the current, good faith views of the author at the time of publication. Any information contained in this material is not and should not be regarded as investment research or derivatives research as determined by the U.S. Securities and Exchange Commission (“SEC”), the U.S. Commodity Futures Trading Commission (“CFTC”), the Financial Industry Regulatory Authority (“FINRA”), the National Futures Association (“NFA”) or any other relevant regulatory body. The author is currently employed at a trading desk. The opinions may not be objective or independent of the interests of the author. Additionally, the author may have consulted with various trading desks while preparing this material and a trading desk may have accumulated positions in the financial instruments or related derivatives products that are the subject of this material.

Spectra Markets does not guarantee the accuracy, adequacy or completeness of the information presented in this material. Past performance and simulation data do not necessarily indicate future performance. Predictions, opinions, and other information contained in this material are subject to change continually and without notice of any kind and may no longer be true after the date indicated. Any forward-looking statements speak only as of the date they are made, and Spectra Markets assumes no duty to and does not undertake to update forward-looking statements. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, which change over time. Actual results could differ materially from those anticipated in forward-looking statements. The value of any investment may also fluctuate as a result of market changes.

Spectra Markets is affiliated with Spectra FX Solutions LLC, an introducing broker that is registered with the NFA; Spectra FX Solutions LLP, which is a registered entity with the U.K.’s Financial Conduct Authority; and SpectrAxe, LLC, a swap execution facility that is currently in the process of registering with the CFTC. The disclosures for Spectra FX Solutions LLC and Spectra FX Solutions LLP related to the separate businesses of Spectra FX can be found at http://www.spectrafx.com/.